Are you thinking about making a gift that benefits both a cause you care about and your financial future? Charitable gift annuities might be the answer you’re looking for.

But are they really a good idea for you? This simple yet powerful tool could offer steady income, tax perks, and a way to leave a lasting legacy. Before you decide, it’s important to understand how they work and what to watch out for.

Keep reading to discover if a charitable gift annuity fits your goals and how it could make a difference for you and your favorite charity.

What Are Charitable Gift Annuities

Charitable gift annuities offer a way to support causes you care about while receiving steady income. This financial tool combines philanthropy with personal benefit. Understanding what they are helps decide if they fit your plans.

What Is A Charitable Gift Annuity?

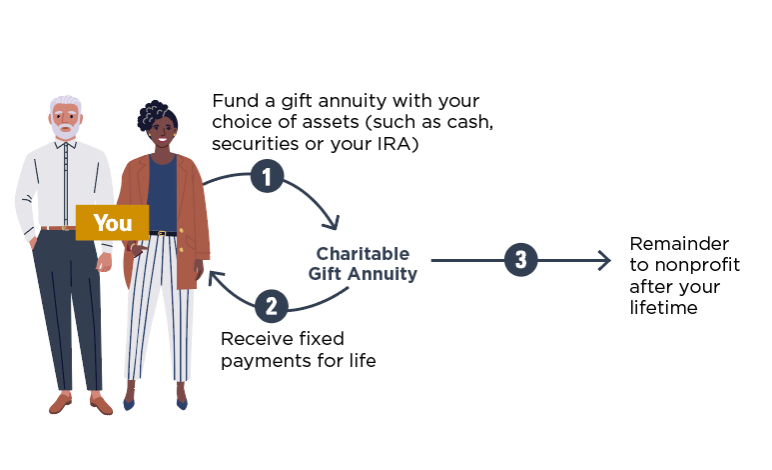

A charitable gift annuity is a contract between a donor and a charity. You give a sum of money or assets to the charity. In return, the charity pays you fixed income payments for life. After your lifetime, the remaining gift supports the charity’s mission.

How Do Charitable Gift Annuities Work?

You transfer cash or property to a charity. The charity calculates your annual payment based on your age and gift size. Payments are usually made quarterly or annually. You receive income for life, guaranteed by the charity.

Who Can Benefit From Charitable Gift Annuities?

People who want steady income and want to help charities benefit most. Older donors often choose this for reliable payments. It suits those wanting a mix of income and giving.

How Charitable Gift Annuities Work

Charitable gift annuities offer a way to support a cause and receive income. You give a donation to a charity. In return, the charity pays you a fixed income for life.

This arrangement benefits both you and the charity. You get steady payments and a tax deduction. The charity receives funds to help their mission.

Making The Gift

You start by giving cash or property to a charity. The gift becomes the basis for your annuity. The charity sets up the contract to pay you.

Receiving Payments

The charity pays you a fixed amount regularly. Payments often start right away or within a year. The amount depends on your age and gift size.

Tax Benefits

You get a charitable income tax deduction for part of your gift. Part of each payment is tax-free income. This lowers the taxes you owe on payments.

After Your Lifetime

Payments stop when you pass away. The charity keeps the remaining gift amount. They use it to support their work and help others.

Benefits For Donors

Charitable gift annuities offer several benefits for donors. They provide a way to support a favorite cause while also gaining financial advantages. Donors receive payments and tax savings, making this option appealing for many.

Steady Income Stream

Donors receive fixed payments for life or a set period. These payments offer financial security and predictability. This steady income can help with budgeting and daily expenses. It feels like a reliable source of money.

Tax Advantages

Donors enjoy an immediate tax deduction for the gift portion. Part of the income received is tax-free. This lowers overall taxable income, reducing the tax bill. Tax benefits make charitable gift annuities more attractive.

Supporting A Cause

Donors help support causes they care deeply about. The gift creates a lasting impact beyond their lifetime. It is a way to give back while receiving financial benefits. This dual purpose appeals to many donors.

Credit: www.acga-web.org

Considerations And Risks

Charitable gift annuities offer a unique way to support causes and receive income. Yet, there are important factors to think about before deciding. Understanding the risks helps you make a smart choice.

Financial Stability Of The Charity

The charity’s financial health matters a lot. If the organization is not stable, it may struggle to pay your annuity. Check their credit ratings and financial reports. Choose charities with strong financial backgrounds. This lowers the risk of missed payments.

Impact On Estate Planning

Gift annuities can affect your estate plans. They reduce the value of your taxable estate. This can lower estate taxes for your heirs. But, it also means less inheritance for family. Think about how this fits your long-term goals.

Potential Downsides

Charitable gift annuities are not risk-free. The payout rates might be lower than other investments. Once set, the annuity terms cannot change. You lose control of the donated amount. Also, annuity payments may be taxable. Understand these limits before proceeding.

Comparing Alternatives

Charitable gift annuities offer benefits, but other options deserve attention. Comparing these alternatives helps you find the best fit for your goals and finances. Each choice has unique features and impacts your giving and income differently.

Charitable Remainder Trusts

Charitable remainder trusts let you donate assets while keeping income for life. You place property or money in a trust and receive payments. After your lifetime, the remainder goes to charity. This option offers flexible income and possible tax benefits. It suits donors who want control and steady income over time.

Direct Donations

Direct donations are simple and immediate. You give money or property straight to a charity. You may get a tax deduction in the year of the gift. This method does not provide income, but it supports charity quickly. Good for donors who want to help now without future payments.

Other Planned Giving Options

Other planned gifts include life estates, bequests, and pooled income funds. Life estates let you give a home but keep living rights. Bequests are gifts through a will, passed after death. Pooled income funds combine gifts to pay income based on shares. Each option suits different needs and giving timelines.

Credit: delcofoundation.org

Who Should Consider Charitable Gift Annuities

Charitable gift annuities suit specific financial and personal goals. They offer fixed income and support causes you care about. Understanding who benefits most helps in making the right choice.

Older Adults Seeking Steady Income

People over 60 often consider charitable gift annuities. They provide a reliable income stream for life. This helps with budgeting and financial planning in retirement.

Those Wanting Tax Benefits

Charitable gift annuities offer an immediate tax deduction. This appeals to donors with taxable income. It reduces tax burden while supporting favorite charities.

Individuals With Appreciated Assets

Donating stocks or property can trigger capital gains tax. Gift annuities help avoid or reduce this tax. Donors receive income and support charity without losing asset value.

Philanthropists Who Want A Legacy

Some want to leave lasting support for causes. Gift annuities combine giving with lifetime income. They create a meaningful impact beyond the donor’s lifetime.

Steps To Set Up A Charitable Gift Annuity

Setting up a charitable gift annuity involves clear steps. These steps help ensure your gift benefits both you and the charity. Following the right process makes everything smooth and effective.

Choose The Charity

Select a charity you trust and support. Check if they offer charitable gift annuities. The charity must be eligible to handle these gifts.

Discuss Terms And Rates

Talk with the charity about annuity rates. Understand the income you will receive each year. Rates depend on your age and gift amount.

Complete The Gift Agreement

Sign a formal agreement with the charity. It states the gift amount and payment terms. This document protects both parties.

Transfer The Gift

Give the gift, usually cash or securities. The charity uses it to invest and pay you. Keep records of the transfer for taxes.

Receive Regular Payments

The charity starts paying your annuity income. Payments can be monthly, quarterly, or annually. They continue for your lifetime or agreed term.

Credit: www.akroncf.org

Frequently Asked Questions

What Is A Charitable Gift Annuity?

A charitable gift annuity is a contract where you donate assets to a charity. In return, you receive fixed lifetime payments. It combines philanthropy with financial benefits like income and tax deductions.

How Does A Charitable Gift Annuity Work?

You transfer cash or property to a charity. The charity pays you a fixed income for life. After your death, the charity uses the remaining funds for its mission.

Are Charitable Gift Annuities Financially Beneficial?

Yes, they offer steady income, partial tax deductions, and potential capital gains benefits. Payments are generally reliable and can supplement retirement income.

Who Should Consider A Charitable Gift Annuity?

People seeking regular income and wanting to support a cause. It suits retirees, donors wanting tax breaks, and those with appreciated assets.

Conclusion

Charitable gift annuities offer steady income and support good causes. They can benefit both donors and charities in many ways. Consider your financial needs and goals before choosing this option. Talk with a trusted advisor to understand the details clearly.

This way, you can decide if a charitable gift annuity fits your plans well. Giving wisely helps you and those you care about. Simple, smart, and kind.

When you purchase a product through Amazon links on widgetygoodness.com, we may earn a commission at no extra cost to you. This helps support the site and keep our content free. As an Amazon Associate, I earn from qualifying purchases.